Start A POS Business In Nigeria (Complete Guide) In 2022

This easy and practical guide on how to start pos business in Nigeria in 2022 was made possible thanks to the contribution of 5 different pos business owners with at least 3 years experience.

Table Of Contents

DO YOU NEED A POS MACHINE?

For a giveaway price of #65,000 today, have an Android POS 4G/3G machine delivered to your door step for free.

This comes with a free Manuel/guide on dark top secrets you can apply to run a successful POS business fast.

The following details will be required if you want it registered for you

- Full name

- Phone number

- Business name

- Address

- Bank

- Account Number

- Account Name

- BVN

- Email address

- Date of birth

- passport and

- valid ID card

Note that the registration is also free.

Click on the WhatsApp icon displayed on your screen below to own one right away.

(full payment to be made on delivery)

There’s a saying:

The best way to learn is to listen to an expert… That’s what team entlifeonline did by interviewing successful pos business owners to get valid information on what to do and what not to do.

So be sure to carefully read and digest all the information here as they are based on experience.

Look:

Clement, a pos business owner for 4 years shared why this business is a big deal currently

According to him, POS business has to a great extent encourage CONVENIENCE in the transfer of funds, collection of funds and payment of bills. And that’s why the business is not just lucrative but also one of the high-in-demand businesses in Nigeria.

This is because it is

-

Swift and reliable: Very fast with above 80% success rate for every transaction.

-

Easy: Not highly technical and doesn’t require special skills

-

Affordable: ₦50 for each transaction of ₦500 / ₦1000 isn’t a big deal.

-

Available in large quantity: Withdrawal, payment and transfer huge sums is possible .

…it’s why people around will rather patronize you than experience long queues at the banking hall or ATM junction, spot or corner.

Now that you know to start a pos business will be a smart move because of the convenience it provides as an alternative to visiting banking halls; allow me to take you through all you need to know as regards starting a pos business on your own.

You might Also Like This : For a detailed guide on how to start a football viewing centre, click here .

NOTE: Make sure you read everything in the first step and you can contact me for a Pos machine at an affordable fee.

How To Start POS Business In Nigeria In 2022

1. Source for a good location.

Your location is basically the place your business will be sited, so its something you literally can’t do without. Although having a good location is important in every business, it plays an advanced role here. If you can get your location spot on in this pos business your success is 50% done already. I can tell you that it has special benefits that ensure you’ll be successful.

When you want to start a pos business in Nigeria, below are some of the key things you should consider before settling for a particular location.

- Network

You understand good service is very important in the more is pos business right? This is because while a location with good network/service will ensure smooth daily transactions, a location with a bad one will give you lots of headaches; And your first-time customers will likely not come back.

For example, imagine a scenario where a client wants to withdraw, he then transfers the amount he wishes to your account. He’s seen his alert for the transaction but you haven’t seen yours.

And because of that, you can’t release funds to him. What if it’s an emergency the person couldn’t attend to because of the delay? That’s bad customer service and experience. If such happened to me, I’ll never patronize you again. And that’s why this area should be carefully considered when you want to start a pos business

- Number of competitors

Some people run out of business before they start one, and that’s due to their inability to put minor things in place. Needless to say, your competitors are those into agent banking services of a pos business.

However, the ones that you should worry about are those that operate in your desired area of operation (that’s where you want to site your pos business). Secondly, those that are closest to your desired area of operation should also be carefully analyzed.

In the pos business, every other individual into it does the needful which include all but not limited to withdrawal, transfer of funds etc. In essence, there’s little difference you can make.

Therefore, the best that can happen to you is to site your pos stand business at a place with no/zero competition.

Pro Tip: Perhaps after carefully analyzing a place you feel you can have an edge based on your special skill, make sure those that are already into same/similar services (pos business) are not more than 2 or 3. As I said, there’s little difference you can make. Most especially, if those currently operating there are very professional. So please that this very seriously. You don’t want to run out of business before even starting.

- Nearness to banks.

Whether you decide to start a pos business in a rural area or urban area; there’s none that won’t birth magnificent result if or when done properly.

The benefit of starting a pos business in a rural area is you’ll directly or indirectly add to their development; and also make sales. However, have in mind occupants of rural areas don’t really patronize financial institution; as they’ll rather keep their money at home.

Moreover, in urban areas, the need for instant gratification is on the rise. People want things like right now. That’s why they don’t do long queue. Furthermore, keep in mind that people in urban areas are exposed to loads of information and latest technology which makes them a bit more knowledgeable.

For example, I rarely patronize pos business owners to do transfers and make some other payment. That’s because I can easily make use of mobile banking and the internet is my friend. But my dad patronizes agent banking service personnel for almost everything that has to with payment, withdrawal and transfer of funds. Heck, even buying of recharge cards. Never mind why.

Therefore, ensure you analyse and understand the area and your target audience. This will help you figure out what you stand to gain, and what you stand to lose.

In a nutshell, just ensure your site/locate your agent banking service business/pos business stand at a developing area where there’s little or no banks nearby.

Why?

Because you don’t want people to be like – why will I pay you money when I can go to my bank or the nearest atm and back in less than 10 minutes.

In essence, a place whereby the nearest bank could cost at least ₦200 to reach should be considered.

- Level of crime rate or theft rate .

Because you’ll be dealing with cash, you need to take this very seriously.

People are hungry and very desperate, I’m sure you know this already. So your task here is to visit your desired location for your pos business and pop up this question to a business owner around there.

- Good afternoon sir/madam, how many years have you been working here? And please when was the last time you experienced theft here?

You want to get a positive reply from persons running their businesses at that location for at least 2 years. And in most cases, when you get zero theft cases as a reply is best.

So when you want to start a pos business, do a theft or crime research on the location. This is to ensure the place is crime-free and it’s very safe to operate your type of business since you’ll be dealing with lots of cash at hand. You don’t wanna get robbed while trying to grow a business.

In summary, a place with zero or no crime rate is best to launch your own pos business stand in Nigeria. For the sake of your sanity, don’t neglect this.

Other factors you should consider while sourcing for a location when you want to start a pos business in Nigeria are as follows

- Population: the more populated an area is, the more likely you’re going to get lots of customers.

- Profile of people living there: the rate at which you’ll make sales at a place occupied by or with rich people will differ from average income earners. The rich in most cases deal with a very large amount of money which they’ll rather patronize their preferred bank. So for the best result, the area should be occupied by average individuals. Because the poor will rather trek to that bank to avoid you paying a penny.

- Rules and regulations guiding the area.

- Etc.

If you know someone into fashion design business, this guide might help the grow

For groundnut farming easy guide click here

2. Draft your post business plan.

Every business needs a very good business plan. And this business plan is nothing more than a guide for your pos business.

As an entrepreneur, you want to start a business with certain aims and objectives.

And to make sure you achieve those aims, you need something like a pathway you need to follow in other to achieve them via varieties of strategies

So after making a decision on a location, estimate the cost needed to get a shop there; plus other cost and write your business plan. This is something you can do yourself following simple guidelines. But if you can’t, get a professional to help you out. If you need a business plan template, drop a comment.

3. Raise the needed capital to start a pos business

The next step on how to start a pos a business is to source for the needed amount of money to launch the business.

I know you know finance is key in starting a business so I’m not going to bore you with unnecessary talks here.

Below are some of the ways to raise capital in other to open your own pos business.

- Savings

It’s possible you have this already but if you don’t, here is how to go about saving up funds.

Get a job. I know this hard to come by in Nigeria. But in other to ensure you have savings for your pos business, get a decent paying job and save up part of your monthly salary or weekly wages.

👉 Get Free ₦1,000 plus 5% – 15% interests on savings and over 25% return on investments:

Create a Free Account on PiggyVest!

- Meet friends and family for financial assistance:

During the process of reaching out to your loved ones for help to start a pos business, a couple would like to know how much is coming out of your pocket to get the business started. And that’s why savings is the first on my list to raise capital. Because without it, some people will judge you to be not serious about starting your pos business. And they simply won’t help you.

- Contact your preferred financial institutions for a loan.

I believe this is self-explanatory. But needless to say, its something that doesn’t come easy without collateral. But if you have your collateral then it’s very possible. All you have to do is go to your bank and meet up with customer service personnel.

- Seek investors

Now, this I highly recommend. And with your well-written business plan, it could turn out to be the fastest way to raise the needed money to start a pos business .

The majority don’t like giving out something without expecting anything back in return. So if you meet an uncle or anyone with a business plan that clearly outlines what they stand to gain when they invest in your business; they’re more likely to support you.

- Lastly, you can reach to cooperatives (ajò,) for a loan to start a pos business.

Read Also : see all you need to start a tricycle busines s even if you own one or know how to drive one.

4. Get a shop and set it up

You never can tell how many people have made an enquiry about the shop at your desired location. Yes, the exact one you’re looking forward to renting. So immediately after getting the finance needed to start your pos business, go secure that shop.

In a situation where there are no shops available there, you can get a container and mount it there.

Containers are very expensive these days so if you’re on a very tight budget, you can meet a welder to help you come up with something good. That you should be around ₦70k max.

Furthermore, if you can’t afford ceilings, for now, you can reach out to selling refrigerators for cartons you can use. It’s just a temporary means of reducing heat. Don’t forget to have your shop well painted.

See, based on the quality of this article, something like this is what I expect you to set up

Note: You’ll also need some funds at hand and in the bank to start your pos business. So in case, someone wants to withdraw, you’ll have the cash to give.

Read Also: With just a sewing skill, this guide will show you 16 different methods of making money.

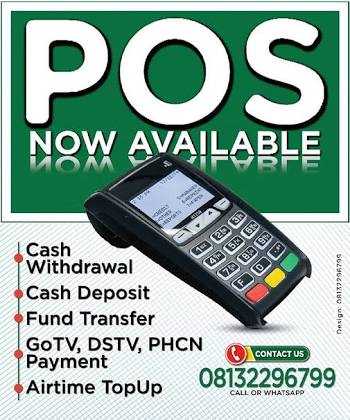

5. Get your pos business banner.

Below us the sample of a banner…

A banner is also a way of creating awareness for what you do. In essence, you want to make it as detailed and compelling as possible.

Mandatory details you must include in your banner include

- Your business name

- Contact details (phone number, email address)

- services you render (e.g subscription, recharge card, withdrawals etc)

- Shop address

- Etc

6. Acquire a pos machine.

They’re three ways you can probably acquire a pos machine.

- Banks

- Agency banks.

- Or contact me directly

Consideration while getting a pos machine.

- Good network/service

- Check their transaction charges:

some pos charges 0.65% plus ₦10 for any transaction below ₦10,000. And they charge ₦50 for any transaction above ₦10,000. Meanwhile, there are others that only charge ₦10 for any type of transaction. Whether you’re sending or receiving the service charge doesn’t change.

PRO TIP : Because these charges are subject to change, take your time to find out or investigate to know more about their current charges and their services. Do this the exact time you want to start a pos business.

Requirements and how to apply for a pos machine from banks

- You must have a current, savings or corporate account with the bank.

- Account number

- Phone number(s)

- Business email address

- etc

Visit your bank and you’ll be given a form which you’re expected to make use of the above details and sign.

After that, you’ll be directed to an account officer. The account officer will start processing your document within 72 hours; and hopefully, under 14 days, your pos will be ready for pick up or delivered to your business location or shop.

BANKS TO GET THE POS MACHINES

Below are some of the banks you can reach out to for pos machine to start your pos business in Nigeria

- Guaranty Trust Bank

- UBA

- Zenith Bank,

- First Bank,

- Access Bank,

- Ecobank,

- Skye Bank,

- Fidelity

- Diamond bank

- Polaris bank

- etc

Here’s how to apply and get a pos machine from Polaris bank according to polarisbanklimted,

- Open a current account with Polaris Bank

- Complete the POS request form (you can download from here)

- Submit the form to your account officer or the customer service officer at your branch

The POS will be deployed within 5 business days of receipt of request from any of our Lagos branches (allow for 3 additional workdays for a request submitted in branches outside Lagos).

See screenshot below…

The disadvantage of getting a pos machine from the bank is that you’ll be given a target. The reason this can be judged to be a demerit is that you’ll like to be on your own without any pressure. However, you can look at it from another perspective and see it as a motivation.

Furthermore, the advantage of this is that you can add extra charges to the ones recommended or given to you by the banks. Therefore, you stand a good chance of making extra money.

Although banks give their pos machine for free, to collect am Nah war ooo. Some can only give you their pos machine if you can guarantee just 1 million naira sales per day. Other criteria are if you guaranty your customer base is currently above ₦1000.

Note Different strokes for different folks. Each bank has its own model of operation plus requirements, just visit your preferred bank for details on what’s needed.

Other agencies you can get your pos machine are as follows

- Micro Finance bank

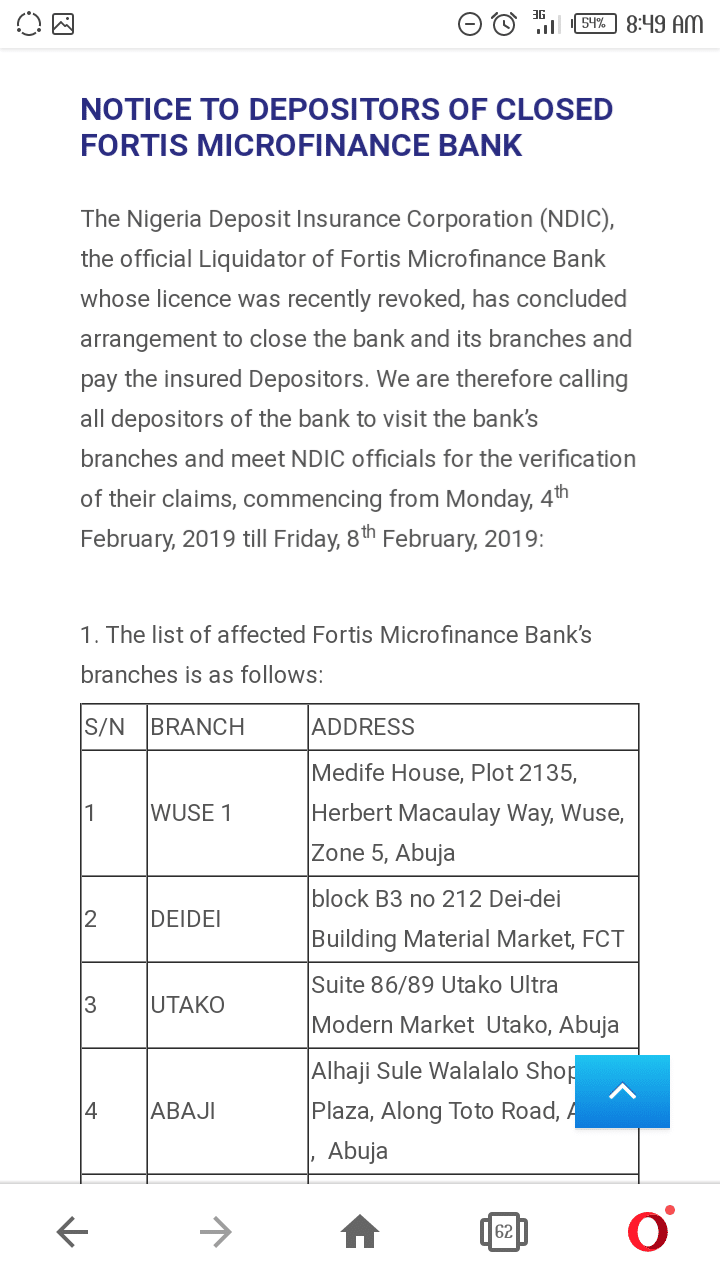

According to research, a few microfinance banks do give out pos machine. However, there’s a need for you to register as an agent mobile money company. Example include fortis microfinance bank.

Importance notice: As at when this post is being published Fortis are having issues being addressed by the Nigeria deposit insurance company

See screenshot below for more information

For full details click here

It’s possible the issue has been rectified as at when you’re seeing this; So I’ll advise you do your personal research. Having said that, you can also reach out to other microfinance banks around you as its more likely they’ll be offering pos machine to business owners.

INTERSWITCH: Interswitch , in summary, is an instant debit and credit but it does not accept visa cards for now.

Other mobile money operators example are

- Quickteller,

- Paga

- Branpos

- Pocketmonie

- Firstmonie

- Opay

- Paycentre

- Nexgo Pos

- citiserve

- etc

Also See:

- Expert tips on how to snacks business in Nigeria (complete guide)

- Know how to open and run a successful transportation business in Nigeria using Mr Yomi’s guide .

FAQS

How much does it cost to start a pos business in nigeria?

The cost or amount needed to start a pos business differs based on three principles

- The scale of the business (small, medium or large)

- Services rendered

- Type of pos machine.

I’ll explain:

You’ll agree with that the amount needed to start a micro & small scale business will differ from that of medium scale.

For example, if you’ll need like 150k to start a pos business on a small scale, at least around 250k will do for medium scale.

For services, the more the services you intend to render, the more investment you’ll need. Example; you can start a pos business with just ₦50,000 – ₦100,000 if you only focus on withdrawal service. You don’t even have to rent a shop. All you need to do is seek a small space at the front of a well-patronized complex or beside it; mount your umbrella. With just your pos machine and cash at hand, you’re good to go.

For pos machine type, the basic difference is on the preferred network type. A pos machine with 2G and 3G will differ from that 4G in terms of speed and price.

However, the cost to start a pos business in Nigeria should be around ₦250,000 at least. If you intend to offer just one service (e.g withdrawal) ₦150,000 will do.

Note that you’ll need some cash at hand to make the withdraws possible. Also, prices of starting are subject to change on your location.

It depends on the services you want to be rendering and the kind of pos you want to acquire.

If you are getting it from the bank you will need from ₦100,000 and above for transaction. That is outside the shop. But if you are buying from an agency company then you need ₦300,000. So ₦100,000 can take care of the POS machine while ₦200,000 will be for money payment for withdrawal. Remember you must have cash in your bank account for transfers.

Read Aslo: Complete guide to starting an internet cafe or cyber cafe business in Nigeria

Benefits of starting a pos business in Nigeria (according to Polaris bank limited)

- Convenient means of payment for customers thereby increasing turnover

- Online real-time monitoring of transactions Improved accounting and reconciliation systems

- Reduction in the risk of carrying cash.

- Ability to generate electronic receipts for payments

- Efficient support which guarantees timely response to feedback

Possible challenges on how to start a pos business.

- Theft

- Network issues

- Power issues

Recommended For You

- Check out this 41 products that are fast selling and highly demanded in Nigeria right now

- Pizza Business: Step By Step Guide

Conclusion on how to start pos business.

Firstly, if you didn’t read everything on step 1 go back now and read it.

Secondly, try to create a good relationship with just not your customers but with other business owners around you.

Because when their customers are short of cash, they can happily refer them to you. And when you are also short cash, you can easily transfer cash to their account while they give you the cash.

Thirdly; successful businesses are well managed. So embrace proper management techniques.

Trending : if you know someone that wants to start an online business, here are helpful tips that can guarantee their success.

My intention was not to make this post too long, but that’s what happens when you want a quality guide.

Meanwhile, it’s possible i missed a thing or two but will be delivered as a reply to your comment.

Therefore, if there’s ANY ADDITIONAL INFORMATION you need to know on how to start pos business in Nigeria in 2022 ,

This guide can also come in handy for individuals interested in starting a Pos business in Ghana, Uganda, Cameroon and basically other African countries.

Lastly, you can also use the comment section for your contribution to this topic

Knowledge isn’t power. Applied knowledge is power.

So take action on all the knowledge you’ve gathered reading this article.

Thanks for stopping by.

👉 Get Free ₦1,000 plus 5% – 15% interests on savings and over 25% return on investments:

Create a Free Account on PiggyVest!

P.s there are a few businesses that require just 100k to start in Nigeria, click here to know them

DO YOU NEED A POS MACHINE?

For a giveaway price of #65,000 today, have an Android POS 4G/3G machine delivered to your door step for free.

This comes with a free Manuel/guide on dark top secrets you can apply to run a successful POS business fast.

Click on the WhatsApp icon displayed on your screen below to own one right away.

(full payment to be made on delivery)

Got great valued from this write up.

God bless you for this.

Thanks for this wonderful article it is given me more insight about POS business. Please i need a business template

Hi David,

You can contact me or reach out to a business developer to help draft a suitable template.

Thanks for sharing sir.

But please, how do I deal with competition?

Hi jamiu

I think one of the ways to dealing with competition is by promising speed.

Nigerians somewhat impatient; and always in a hurry.

So by making sure you are not wasting their precious time, unlike other Pos business owners around you, they would always prefer to deal with you.

Thanks for the in-depth information, I certainly like and enjoyed reading it.

Thanks for letting me know the effort was worth it.

Will a place that has Mtn network issues. Affect the pos

It depends on the network of the POS machine

Please I would love to see an example of a business plan template, thank you.

You can contact me privately by clicking on the whatsapp icon displaying on the screen or send a mail to [email protected]

Wow. This write up was well detailed. I feel well informed. Thanks.

I would like to know if buying a POS machine from a 3rd party agent eliminates setting targets and also, if said target is not met, what happens to the POS?

Charges from banks and from 3rd party agents, which is more?

Well detailed and understood.

Please how may i get the POS BUSINESS PLAN TEMPLATE.

Thank you

Very happy I learn more today ,I am very interesting In the pos business .how can I get the pos machine